Customer

Zurich Insurance company in Austria belongs to the globally active Zurich Financial Services Group and has a workforce of around 1,200 employees. In Austria, Zurich Insurance Co. cooperates with around 3,500 independent brokers. The broker management and information system is a pivotal component of collaboration.

Highlights

- Central online database system with comprehensive broker information and market data

- Data import, aggregation and reporting from 12 sub-systems

- Management cockpit with all KPIs

- High-performance aggregation and visualisation of large volumes of data

- Business process mapping

- Work process optimisation through standardised dialogue guidelines (Wizard)

Facts & Figures

- 3,500 brokers in Austria

- 2 million postings

Technologien

- Windows Server

- MS SQL

- ASP.NET

Initial situation: Distributed data management in 12 sub-systems

Broker supervision at Zurich Insurance Co. is organised regionally by sales areas. Information made available to brokers by their supervisors is also subjected to decentral management. Every supervisor obtains the necessary information self-responsibly from various sub-systems (Excel, Host, Lotus Notes, Word, etc.).

Distributed data management meant that information was often duplicated or no longer up to date. Accordingly, there was no standardisation in the broker supervision process, no standardised view of KPIs and no networked options of evaluation. Consequentially, segmentation or augmentation via profitability criteria was not possible.

“We needed a central system for our broker management to support a more professional and customer-oriented presence in the Austrian marketplace”, says Mag. Florian Weikl, Head of Sales, Brokers and Agencies at Zurich Insurance Co., in summarising the initial situation.

The solution: A central online database system

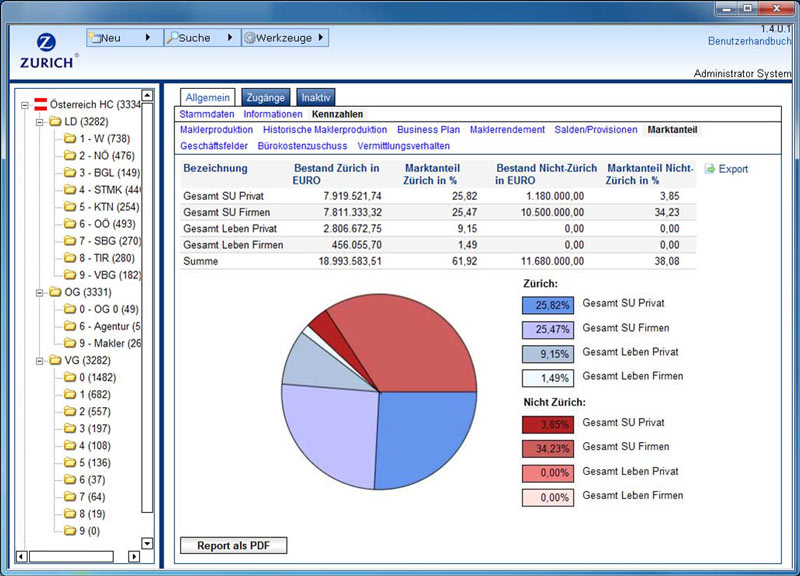

A central online database system for brokerage business was created to meet the demand. The data distributed across 12 sub-systems was collated, aggregated and presented as graphic images. The result was a management cockpit aimed at optimising decision-making and broker supervision.

“One of the main challenges during implementation lay in the provision of data from the different sub-systems that is made available at different times and in different formats. This is where consistency needs to be maintained”, explains RUBICON project manager Thomas Wundsam.

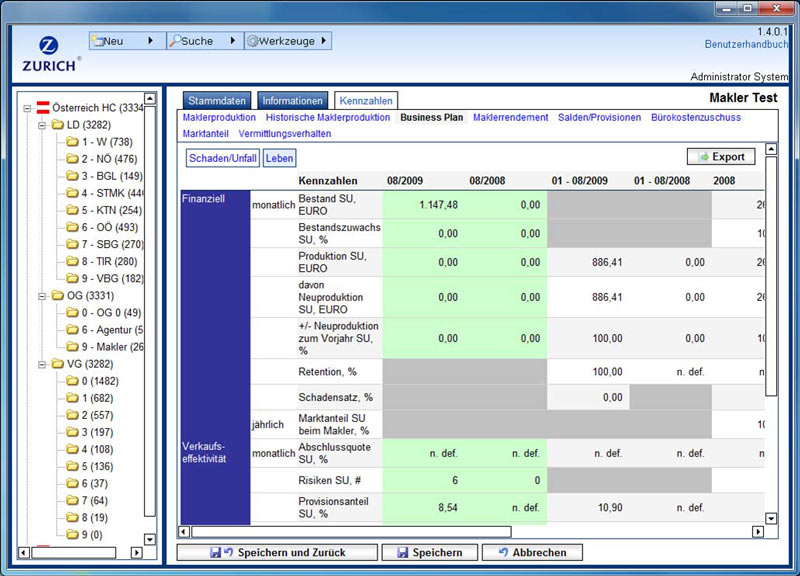

KPIs are evaluated and clearly presented in the management cockpit. Complex reports are presented together with tables and diagrams in an easily comprehensible form. The information gained in this way serves to control broker activity.

“It is especially important to be able to display the huge volumes of data efficiently and in different aggregations. A business intelligence solution based on MS SQL Server was implemented for this purpose. Cubes calculate the defined KPIs and place them in relation so that ad-hoc queries and reports can be processed at a much faster rate”, says Thomas Wundsam in explaining the benefits of the solution developed by RUBICON.

The software system comprehensibly maps broker supervision processes and documents every contact. Master data, KPIs, appointments, deadlines, measures and events specific to each broker are centrally managed and there is a shared database for quotes and information material.

Structured questionnaires for annual appraisals and regular contact are also provided in the form of a wizard. These measures standardise appraisal guidance and ensure a uniform external appearance.

Benefits at a glance

- Information and knowledge from a single source: a central system for broker activity accessible to all departments with an overview of all relevant market data and brokers

- Evaluation and implementation of performance goals on the basis of defined KPIs

- Increase in the efficiency and growth of broker sales

- Information and evaluations as a basis for management decisions

- Standardisation and optimisation of work processes (e.g. annual appraisals)

- Mapping of business processes between headquarters and brokers including documentation of cooperation

- Web-based online database – no distribution of software

- Changes are immediately visible everywhere

- Minimisation of the cost of data supply and delivery

The software gives us the ideal tool to manage, support and inform our brokers and, in doing so, to increase the efficiency of broker-based sales. The centralised preparation of KPIs enables us to better control broker activity and achieve our growth objectives.